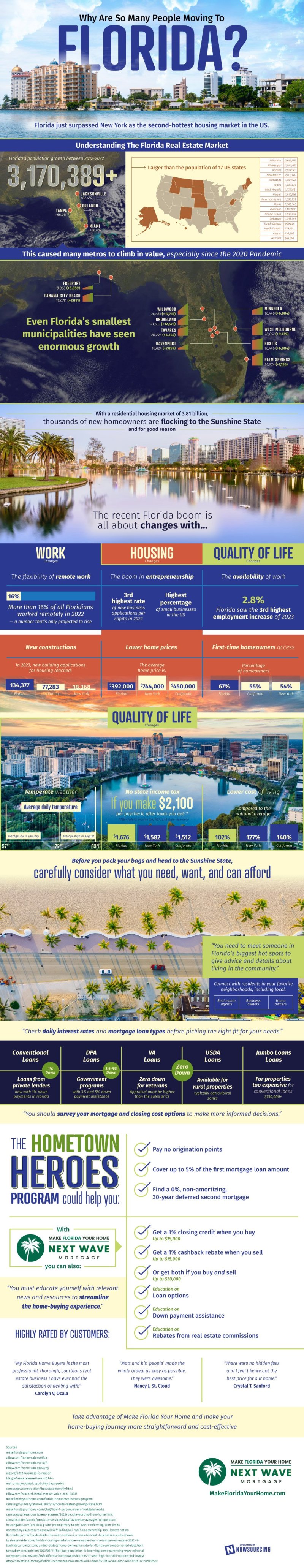

Florida has been a long-standing destination for those who have reached retirement age. But it seems that many more than just retirees have sought out the ‘Sunshine State’. Key cities such as Tampa, Miami, Orlando, and Jacksonville have exploded with over 70% increases in population. This is paired with a variety of economic factors that are furthering the development of the state. From the highest percentage of small businesses in the country to much higher availability for homes than other major states like California or New York. But what is driving some people to seek out Florida specifically? One aspect of it is the possibility of remote work. One consequence of the pandemic is that companies are now able to offer job positions in an entirely virtual format. Seeing as you don’t need to be in the office, you can enjoy the sunshine in Florida while completing what you need to at work. In fact, it is estimated that over 16% of all Floridians worked entirely remotely last year.

On the other hand, Florida has also seen a boom in new businesses. The state ranks 3rd highest rate of new businesses applications per capita and has the highest percentage of small businesses in the U.S. And, in terms of living situations, Florida boasts a lower cost of living than major states with no income tax, with a temperate climate to top it all off. While these benefits remain enticing to many, picking up and moving to Florida into the newly constructed Florida homes is not quite so simple. When purchasing a home, many compounding factors such as fluctuating daily interest rates or the multitude of loan types serve to impede a smooth transition to the Sunshine State and to obfuscate the process of homebuying.

For instance, someone who qualifies may benefit more from a DPA governmental loan that has down payment assistance, compared to a conventional loan from private lenders. But with this inauspicious collection of factors to account for, many prospective homebuyers may suffer ‘paralysis by analysis’. Fortunately, many Florida companies have arisen to help those looking to move become Florida residents. Next Wage Mortgage, for instance, enables customers to get 1% credit on buying or selling of a property, while educating clients about down payment assistance and potential rebates. By providing both education and expertise, people who go with mortgage companies can maximize their cost-effectiveness and streamline the process of finding a new Florida home.

Ultimately, the state of Florida has a plethora of benefits that appeal to many. Whether the reasons are rooted in economic viability or personal preferences, Florida can accommodate just about anyone. But in order to be in a position to enjoy the Sunshine State, you need to make the move as easy as possible. The easiest way to do this is through a mortgage company like Next Wage Mortgage. With resources to educate and the ability to more easily afford properties, mortgage companies are the best way to find your new home as soon as possible.

WebProNews is an iEntry Publication

WebProNews is an iEntry Publication